|

Trade Tools and Support Tools

Trade Tools and Support Tools | Trade Tools | Support Tools |

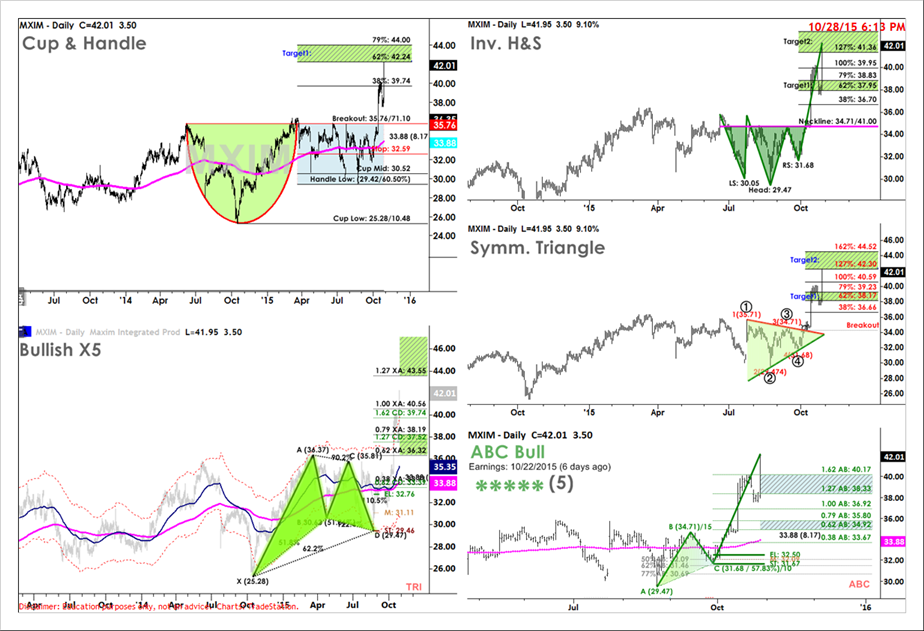

| ABC, Head and Shoulders, Gartleys (all X5), Channels, Cup and Handle, Parabolic Arc, Triangles | Super Bars, CMI, VLTY, Trail Stops, Market Structures, Pivots (Floor, Globex, Fib. Zone) |

Books/Poster

Books/Poster  Indicators

Indicators  Patterns

Patterns  Blog Posts

Blog Posts  Blog Categories

Blog Categories  Combo Package Offers

Combo Package Offers